ashlisurratt8

About ashlisurratt8

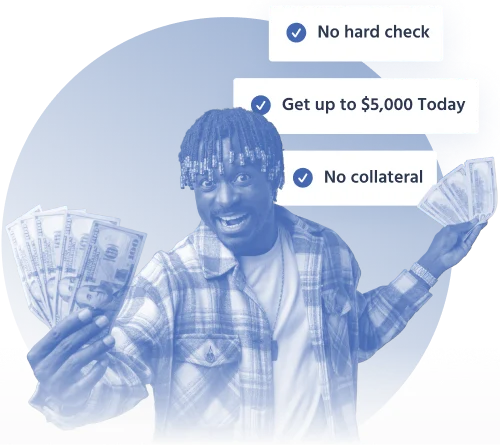

Small Instant Loans with No Credit Check: A Financial Lifeline for Many

In today’s fast-paced world, financial emergencies can arise at any moment. Whether it’s an unexpected medical bill, car repair, or a sudden job loss, having quick access to cash can make all the difference. For many, traditional lending options may not be feasible due to poor credit history or lengthy approval processes. This is where small instant loans With no Credit check – https://bestnocreditcheckloans.com, come into play, providing a much-needed financial lifeline for individuals facing urgent monetary needs.

Understanding Small Instant Loans

Small instant loans, often referred to as payday loans or cash advances, are short-term loans designed to provide quick access to funds. These loans typically range from a few hundred to a few thousand dollars and are meant to be repaid within a short time frame, usually within a few weeks or by the next payday. The appeal of these loans lies in their accessibility; lenders often do not require a credit check, making them available to individuals who may have poor or no credit history.

The No Credit Check Advantage

One of the most significant advantages of small instant loans is that they do not require a credit check. Traditional lenders, such as banks and credit unions, often scrutinize applicants’ credit scores, which can be a barrier for many. In contrast, lenders offering no credit check loans focus more on the applicant’s income and ability to repay the loan rather than their credit history. This opens the door for individuals who may have faced financial difficulties in the past but are currently in a stable position to repay a loan.

Who Can Benefit?

Small instant loans with no credit check can be beneficial for a wide range of individuals. Those who have recently faced financial hardships, such as job loss or medical emergencies, may find themselves in need of quick cash. Additionally, young adults who are just starting their financial journey and may not yet have an established credit history can also take advantage of these loans. Furthermore, individuals with fluctuating incomes, such as freelancers or gig workers, may find these loans helpful in bridging the gap between paychecks.

The Application Process

Applying for a small instant loan is typically a straightforward process. Most lenders offer online applications that can be completed in just a few minutes. Applicants are usually required to provide basic information, including their name, address, income, and bank account details. Some lenders may also require proof of income, such as pay stubs or bank statements, to ensure that the borrower can repay the loan.

Once the application is submitted, lenders often provide quick approval decisions, sometimes within minutes. If approved, funds can be deposited directly into the borrower’s bank account within a few hours or by the next business day. This rapid turnaround is one of the key selling points of small instant loans, as it allows individuals to address their financial emergencies without lengthy delays.

The Risks Involved

While small instant loans with no credit check can provide immediate relief, they are not without risks. The convenience of these loans often comes with high interest rates and fees, which can lead to a cycle of debt if borrowers are unable to repay the loan on time. It’s important for individuals considering this option to thoroughly read the terms and conditions, understand the repayment schedule, and assess their ability to repay the loan within the specified timeframe.

Moreover, borrowers should be cautious of predatory lending practices. Some lenders may take advantage of individuals in desperate situations, charging exorbitant fees or imposing unfavorable terms. It’s crucial to research lenders, read reviews, and ensure they are reputable before proceeding with a loan application.

Alternatives to Consider

For those who may be hesitant about taking out a small instant loan, there are alternative options to consider. Credit unions and community banks often offer small personal loans with more favorable terms and lower interest rates compared to payday lenders. Additionally, some employers offer paycheck advances, allowing employees to access earned wages before the official payday.

Furthermore, individuals can explore assistance programs offered by non-profit organizations or government agencies that provide financial aid for specific needs, such as medical expenses or housing costs. Building an emergency fund, even a small one, can also help individuals avoid the need for high-interest loans in the future.

Conclusion

Small instant loans with no credit check can serve as a vital resource for individuals facing unexpected financial challenges. They provide quick access to cash without the barriers of traditional credit checks, making them an attractive option for many. However, potential borrowers must approach these loans with caution, understanding the associated risks and costs. By researching lenders, considering alternatives, and assessing their financial situation, individuals can make informed decisions that will help them navigate their financial emergencies effectively.

In an ever-changing economic landscape, the ability to secure quick funds can be a game-changer. Small instant loans with no credit check may not be the ideal solution for everyone, but for those in need, they can offer a crucial way to regain financial stability and peace of mind.

No listing found.